Overview

The San Dimas Silver/Gold Mine is 100% owned and operated by First Majestic Silver Corp. having been acquired in May 2018 as a result of the acquisition of Primero Mining Corp. The San Dimas operation has since become the cornerstone asset in First Majestic’s portfolio. The San Dimas property contains 71,867 hectares of mining claims located in the state of Durango, Mexico.

Stage

Production

Resource

Silver / Gold

Ownership

100%

Hectares

71,867

2024E Production

9.8M – 10.4M AgEq OZ

(5.2M – 5.5M Ag oz + 56K – 59K Au OZ)

2024E All-In Sustaining Costs

$18.69 – $19.45

Proven & Probable Reserves

37.8M Ag + 460K Au oz

Measured & Indicated

54.5M Ag + 681K Au oz

Inferred

42.0M Ag + 489K Au oz

Location

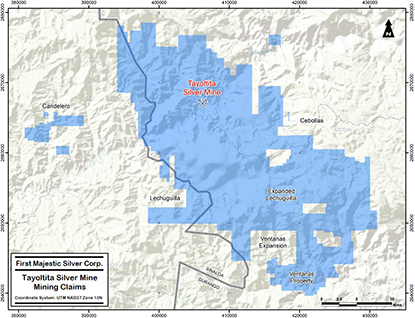

The historic mining town of Tayoltita, located adjacent to San Dimas, is an important population centre with approximately 8,000 inhabitants. San Dimas currently employs approximately 1,800 people.

The San Dimas deposit is considered to be one of the most significant precious metal deposits in Mexico, situated within a very large (15 square kilometre) mining district. Historic production from the San Dimas district has been estimated to total 11 million ounces of gold and 582 million ounces of silver.

The San Dimas mine consists of five ore zones or blocks: Central, Sinaloa Graben, Tayoltita, Arana Hanging Wall and San Antonio West, contained within a 22,500 hectares contiguous property. San Dimas uses long-hole stoping and mechanized cut-and-fill underground mining methods, with all mined production processed at the Tayoltita mill. After milling, cyanidation, precipitation and smelting the doré bars are poured and transported to refineries in Mexico and the United States.

Water for mining operations is obtained from on-site wells and from the Piaxtla River. San Dimas also supplies water to the town of Tayoltita from an underground thermal spring at the Santa Rita mine. Electrical power is obtained through a combination of wholly-owned power systems and the Federal Power Commission’s supply system. San Dimas operates hydroelectric and back-up diesel generators which are interconnected to the Federal Power Commission system.

Operating Highlights

| San Dimas Production Results | 2023 | 2022 | 2021 | 2020 | 2019 | 2018* |

| Ore Processed/Tonnes Milled and Leached | 875,345 | 787,636 | 822,791 | 713,064 | 691,576 | 435,289 |

| Average Silver Grade (g/tonne) | 240 | 261 | 305 | 297 | 305 | 274 |

| Silver Recovery (%) | 94% | 94% | 95% | 94% | 93% | 95% |

| Total Silver Ounces Produced | 6,355,308 | 6,201,090 | 7,646,898 | 6,399,667 | 6,305,672 | 3,621,868 |

| Gold Ounces Produced | 76,964 | 80,814 | 81,237 | 71,598 | 87,424 | 54,098 |

| Average Gold Grade (g/tonne) | 2.85 | 3.31 | 3.19 | 3.24 | 4.1 | 4.0 |

| Gold Recovery (%) | 96% | 96% | 96% | 96% | 96% | 97% |

| Total Production - Ounces Silver Equivalent | 12,789,920 | 12,957,826 | 13,525,049 | 12,670,526 | 13,831,627 | 8,051,605 |

| Underground Development (m) | 10,678 | 20,520 | 26,070 | 26,154 | 24,021 | 13,063 |

| Diamond Drilling (m) | 78,039 | 64,791 | 99,825 | 87,659 | 76,467 | 43,510 |

| * from May 10 - Dec. 31, 2018 |

Geology and Mineralization

The San Dimas deposit is located within the central part of the Sierra Madre Occidental volcanic pile, containing rocks reflecting two separate periods of magmatism active between 45 to 100 million years ago and 23 to 32 million years ago. The precious metals bearing veins are contained within rhyolitic, andesitic and granodioritic rocks of the older magmatic episode.

Regionally, the geological setting at San Dimas shows two major volcanic successions and a number of intrusive events. The Eocene aged Lower Volcanic Group (LVG) is predominantly composed of andesitic and rhyolitic flows and tuffs, and is intruded by a number of bodies including the dominant Piaxtla Granite (part of the Sinaloa composite batholith). The Tertiary aged Upper Volcanic Group (UVG) is composed of a lower andesitic horizon capped by rhyolitic ash flows and tuffs, and is separated from the LVG by an erosional and depositional unconformity. Subsequent rhyolitic and basalt dykes intrude both the LVG and UVG.

Structurally, the San Dimas district lies within an area of complex normal faulting along the western edge of the Sierra Madre Occidental. Compressive forces first formed predominantly east-west and north-northeast tension gashes that were later cut by transgressive north-northwest striking slip faults. The strike-slip movements caused the development of secondary north-northeast faults, with right lateral displacement.

Locally, precious metal ore is contained in over 120 epithermal veins characterized by low sulphidation and adularia-sericitic alteration, and formed prior to deposition of the UVG. Veins pinch and swell and commonly exhibit bifurcation, horse-tailing, and cymoidal structures. Vein widths vary from less than one centimetre to over 15 metres, but average approximately 2 metres. Veins have been followed underground from a few metres in strike-length to more than 2 kilometres.

Mineralization is typical of epithermal vein structures with banded and drussy textures. Three major stages of veining have been recognized in the district, each containing variable amounts of mineralization. The second stage produced the majority of the ore deposits, which itself included three sub-stages characterized by distinct mineral assemblages, quartz-chlorite-adularia, quartz-rhodonite and quartz-calcite. Sulphide minerals include pyrite, sphalerite, chalcopyrite and galena as well as lesser amounts of argentite, polybasite, stromeyerite, native silver and lectrum.

The ore deposits are typically found within the ‘Favouable Zone’, analogous with the boiling zones. Strike length of these Favourable Zones can exceed 2,000 metres and dip length can exceed 300 metres. Exploration generally relies on a combination of structural geology, geochemistry, and fluid inclusion studies to identify the Favourable Zone. Historical reconciliation has shown that, once the Favourable Zone is defined, over 30% of the vein material contained within the zone will be classified as ore.

For more detailed geological information readers are encouraged to review the Company's most recent NI 43-101Technical Report (PDF).

The Reserves/Resources inventories are reported in NI 43-101 Technical Reports published periodically by the Company. The complete report can be viewed in the Reserves/Resources section or on SEDAR

San Dimas Optimization Plans

Given its extensive 250-year production history in Mexico, San Dimas is one of the country's most prominent silver and gold mines as well as the largest producing underground mine in the state of Durango. However, prior to First Majestic's acquisition and due to poor economic conditions at the time, the operation suffered from a lack of investment. Under the new streaming arrangement as of May 10, 2018, the operation is now generating significant cash flows allowing First Majestic to deploy capital towards exploration and underground development in areas of the mine that were previously deemed uneconomic.

Since the acquisition announcement in January 2018, First Majestic has been developing a long-term mine and mill optimization plan for the future of the operation. The Company has identified numerous projects that will be implemented on an ongoing basis to improve production costs at the mine and processing plant, including:

- Safety screen to improve plant reliability.

- Modernize general plant control and monitoring capabilities.

- Debottleneck and optimize crushing circuit for consistent operation.

- Improve operational reliability and stability of the tailings filtration plant by implementing best practices.

- Modernization of the Merrill-Crowe and smelting operations.

- Adequate ore drives to provide a better profile that improved safety, reduced dilution and optimise ground control.

- Pillar recoveries from old workings based in a comprehensive risk analysis and economic evaluation to optimize safety and improve cost.

Mining and Processing

San Dimas utilizes underground long-hole stoping and mechanized cut-and-fill as the primary mining methods, with LHD equipment feeding haul trucks delivering ore to the mill. Primary access takes advantage of the topographic relief, with adits driven above river level to intersect the veins at depth. Ore is transported from the mining areas to the processing plant in Tayoltita.

The Tayoltita mill has a nameplate capacity of 2,500 tonnes per day. The facility uses conventional crushing/grinding coupled with cyanidation and zinc precipitation for recovery of gold and silver. The mill uses fine crushing and single stage ball milling to achieve a fine grind before passing into the leach circuit. Leaching is completed in a series of tanks providing 96 hours of leach residence time. The pregnant solution is recovered in a CCD circuit with the gold and silver recovered from solution in a zinc precipitation circuit.

Tailings are pumped by a single stage pumping station to the tailings impoundment area located in a box canyon east of the mill site. Gold and silver precipitate is refined using an induction furnace to produce silver/gold doré bars.

Silver Purchase Agreement

Pursuant to the closing of the Primero acquisition by First Majestic on May 10, 2018, a New Stream Agreement was established with Wheaton Precious Metals International Ltd. (WPM) which entitles WPM to receive 25% of the gold equivalent production in exchange for ongoing payments equal to the lesser of US$600 (subject to a 1% annual inflation adjustment) and the prevailing market price, for each gold equivalent ounce produced. As part of the termination of the previous silver purchase agreement, WPM received 20,914,590 common shares of First Majestic.

The New Stream Agreement provides for a number of value creation opportunities with alignment between silver and gold production and increased post-stream cash flow at San Dimas. First Majestic and WPM have agreed to fix the gold to silver ratio that will be used to calculate the gold equivalent production at 70:1, with provisions to adjust the gold to silver ratio if the average gold to silver ratio moves above or below 90:1 or 50:1, respectively, for a period of six months.

The fixed gold to silver exchange ratio as of March 31, 2024, was 70:1

1757 First reported mining on San Dimas deposit

1904 Tayoltita mill built at San Dimas

1940 San Luis Mining Company acquired San Dimas property

1961 Minas de San Luis S.A. de C.V. formed, acquired 51% and assumed San Dimas operations

1978 Luismin S.A. de C.V. acquired remaining 49% of San Dimas

2002 Wheaton River Minerals Ltd. acquired San Dimas

2003 Tayoltita Mill expansion to 1,600tpd

2004 Wheaton River entered into silver purchase agreement, selling all silver from San Dimas at ~ $4 per ounce.

2005 Wheaton River merged with Goldcorp Inc.

2006 Tayoltita Mill expansion to 2,100tpd

2010 Acquired 100% of the San Dimas mine

Changed name to Primero Mining Corp

Amended silver purchase agreement, gaining exposure to silver above minimum thresholds.

2012 Tayoltita Mill expansion to 2,500tpd

2018 First Majestic Silver acquired Primero Mining Corp. and established a new streaming agreement with WPM on only 25% of the gold equivalent production at San Dimas for $600 per ounce.