First Majestic Produces 3.9 Million Silver Eqv. Ounces in Q1'15

April 13, 2015

Download

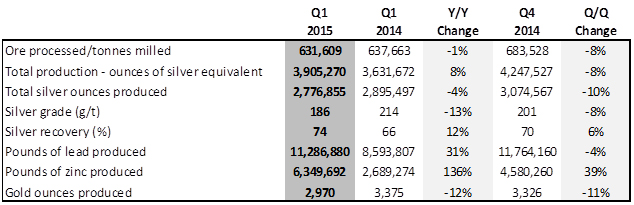

Total silver production for the quarter consisted of 2,776,855 ounces of silver, representing a 4% decrease compared to the same quarter in 2014. In addition, 11,286,880 pounds of lead and 6,349,692 pounds of zinc were produced, representing an increase of 31% and 136%, respectively, compared to the same quarter of the previous year. Also, 2,970 ounces of gold were produced, representing a 12% decrease compared to the first quarter of 2014.

Keith Neumeyer, President & CEO of First Majestic, states, “First quarter production of 3.9 million silver equivalent ounces was in-line with our annual guidance projections even though production was slightly behind our record fourth quarter numbers. Unusually high mill maintenance was required at three of our operations which negatively impacted the quarter. In addition, reduced underground development has restricted the operations. With the irregular maintenance now behind us, we are expecting to see an improvement in production in the second quarter. Also, with the recently announced $30 million financing, we will be increasing development at both the La Encantada and La Guitarra mines in order to improve those operations in time for the second half of the year. We also witnessed the best metallurgical recoveries during the quarter of 74% representing the highest consolidated recovery rate over the past 24 quarters - a testament to our teams focus in this area”.

Consolidated Production Results:

Quarterly Operational Review:

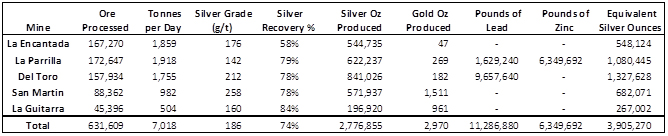

The total ore processed during the quarter at the Company’s five operating silver mines: La Encantada, La Parrilla, Del Toro, San Martin and La Guitarra, amounted to 631,609 tonnes, relatively unchanged compared to the first quarter of the prior year and an 8% decrease from the previous quarter. The decrease in tonnes compared to the prior quarter was primarily due to lower throughput rates at La Encantada, Del Toro and San Martin. Higher than usual mill maintenance was required at each of these mines in the quarter. In addition, due to the persistently low metal prices, management decided to curtail certain underground development projects which impacted throughput levels.

Average silver grades in the quarter for the five mines decreased by 13% to 186 g/t compared to 214 g/t in the first quarter of 2014 and decreased 8% compared with the previous quarter. Combined silver recoveries averaged 74% during the quarter, up from 66% in the same quarter of the prior year and higher than the fourth quarter average of 70%.

The Company’s underground development in the first quarter consisted of 9,828 metres, a 17% decrease compared to 11,772 metres completed in the previous quarter.

During the quarter, 13 diamond drill rigs were operating at the Company’s five operations. The Company completed 5,425 metres of diamond drilling in the quarter compared to 5,990 metres in the prior quarter, representing a 9% decrease.

On March 31, 2015, the Company released a new NI 43-101 Technical Report on the La Guitarra Silver Mine following an aggressive two-year exploration program which included an extensive 35,575 metres of diamond drilling over 262 holes along with the examination of over 900 historical drill holes. The Company is now working towards updating the NI 43-101 Technical Report on the La Encantada Silver Mine which it expects to be released in the second half of 2015.

The table below represents the operating parameters at each of the Company’s five producing silver mines.

Mine by Mine Quarterly Production Table:

The following prices were used in the calculation of silver equivalent ounces: Silver: $16.72 per ounce; Gold: $1,219 per ounce; Lead: $0.82 per pound; Zinc $0.94 per pound.

At the Del Toro Silver Mine:

- For the quarter, Del Toro achieved a new quarterly record production of 1,327,628 silver equivalent ounces representing an increase of 5% compared to the previous quarter. The plant processed 157,934 tonnes of ore through flotation with an average silver grade of 212 g/t. The increase in total production was primarily due to a 22% increase in lead production and a 4% improvement in silver recoveries, however, offset by a 10% decrease in throughput compared to the fourth quarter of 2014.

- Lead production reached a new quarterly record of 9,657,640 pounds. Lead grades and recoveries averaged 4.2% and 66%, respectively, in the first quarter, an increase of 25% and 9% compared to the previous quarter due to higher quality sulphide ore production from the Perseverancia mine.

- Underground development completed in the quarter totaled 1,686 metres compared with 2,095 metres developed in the previous quarter.

- Four drill rigs consisting of three underground and one on surface were active in the first quarter at Del Toro. Total exploration metres drilled in the first quarter amounted to 2,285 metres compared to 559 metres drilled in the previous quarter.

- For the quarter, total silver production was 544,735 silver ounces representing a 31% decrease over the previous quarter primarily due to a 29% decrease in the silver grade, a 10% decrease in processed ore, offset by a 9% increase in recoveries. The reduction in grade was a result of mining lower grade stopes due to the decrease in the underground development that occurred during the quarter. The Company is planning on accelerating the underground development into the recently discovered Ojuelas ore body and is advancing the block caving system in order to have additional production areas ready for the ramp up to 3,000 tpd in July.

- The foundations for the new 12’ x 24’ ball mill and fine ore bin were completed early in the quarter. In addition, the installation and integration of the new tertiary crusher area began in January. The total plant expansion to 3,000 tpd is now 60% complete and the expected ramp up to 3,000 tpd remains on track for July.

- A total of 2,989 metres of underground development were completed in the first quarter compared to 4,344 metres of development in the previous quarter.

- Three drill rigs were active underground at La Encantada during the quarter. A total of 828 metres of exploration drilling was completed in the first quarter compared to 3,367 metres of drilling in the previous quarter.

- During the quarter, the flotation circuit processed 86,965 tonnes with an average silver grade of 165 g/t and an 88% recovery while the cyanidation circuit processed 85,682 tonnes with an average silver grade of 118 g/t and a 66% recovery.

- Zinc production increased 39% compared to the previous quarter to 6,349,692 pounds due to higher grade production stopes within the Vacas mine.

- During the quarter, an additional 235 metres were completed at the underground ore haulage level 11. To date, a total of 2.3 kilometres have been completed on the 5.0 kilometre electrical rail system project.

- Underground development completed in the quarter totaled 2,077 metres compared with 2,378 metres developed in the previous quarter.

- Three underground drill rigs were active within the La Parrilla property during the quarter. A total of 1,437 metres were drilled in the first quarter compared to 685 metres in the previous quarter.

- During the quarter, San Martin produced a total of 571,937 silver ounces and 1,511 ounces of gold for a total quarterly production of 682,071 silver equivalent ounces. The slight decrease in production compared to the previous quarter was primarily due to a 9% decrease in throughput due to numerous shut downs caused by unseasonal heavy rains in the month of March and the repair of the transmission system of the 9’ X 9’ ball mill.

- Underground development completed in the first quarter totaled 2,010 metres compared with 1,414 metres of development in the previous quarter.

- One underground drill rig was active within the San Martin property during the quarter. Total metres drilled in the first quarter amounted to 266 metres compared to 943 metres of drilling in the previous quarter.

- During the quarter, total production consisted of 196,920 silver ounces and 961 gold ounces. This represents a 14% decrease in silver production and a 32% decrease in gold production compared to the previous quarter. The decrease in total production was primarily due to an 8% decrease in throughput and a 22% decrease in gold grades.

- Mine production within the El Coloso area delivered 27,700 tonnes (308 tpd) of ore during the quarter or approximately 60% of total throughput. The Company is working towards achieving 100% of production from the El Coloso area which will include the Nazareno area once an 800 metre drift can be constructed. Construction of this drift is planned to begin in May with completion in approximately six months.

- A total of 1,066 metres of development were completed in the first quarter compared to 1,541 metres of development in the previous quarter.

- Two underground drill rigs were active in the first quarter within the La Guitarra property. Total metres drilled in the quarter amounted to 609 metres compared to 436 metres drilled in the previous quarter.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer

President & CEO

Cautionary Note Regarding Forward Looking Statements

This press release contains “forward-looking statements”, within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of First Majestic Silver Corp. Forward-looking statements include, but are not limited to, statements with respect to the future price of silver and other metals, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of First Majestic Silver Corp. to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the integration of acquisitions; risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Description of the Business - Risk Factors” in First Majestic Silver Corp.’s Annual Information Form for the year ended December 31, 2014, available on www.sedar.com, and Form 40-F on file with the United States Securities and Exchange Commission in Washington, D.C. Although First Majestic Silver Corp. has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. First Majestic Silver Corp. does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.