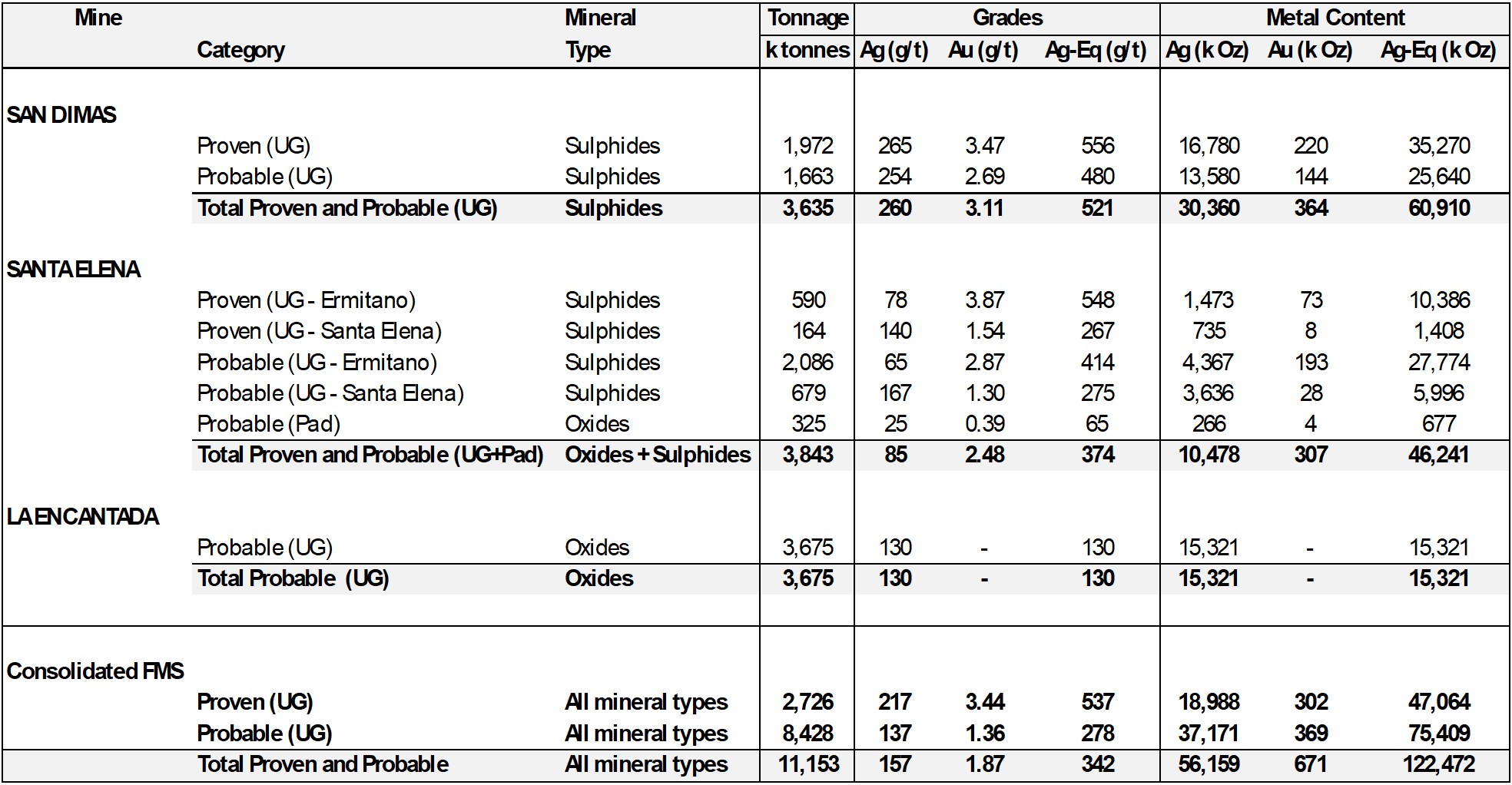

Proven and Probable Mineral Reserve Estimates with an Effective Date of December 31, 2023.

- Mineral Reserves have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101.

- The Mineral Reserve statement provided in the table above has an effective date of December 31, 2023, except for the Santa Elena Leach Pad estimate, which has an effective date of March 11, 2024.

- The Mineral Reserve estimates were prepared under the supervision of, or were reviewed by, Brian Boutilier, P.Eng., Internal QP for First Majestic, who is a Qualified Person under NI 43-101.

- The Mineral Reserves were estimated from the M&I portions of the Mineral Resource estimates. Inferred Mineral Resources were not considered to be converted into Mineral Reserve estimates.

- AgEq is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the selling contract.

- The AgEq grade formula used was:

AgEq Grade = Ag Grade + Au Grade * (Au Recovery * Au Payable * Au Price) / (Ag Recovery * Ag Payable * Ag Price). - Metal prices considered for Mineral Reserve estimates were $22.5/oz Ag and $1,850/oz Au for all sites.

- Other key assumptions and parameters include: metallurgical recoveries; metal payable terms; direct mining costs, processing costs, indirect and G&A costs and sustaining costs. These parameters are different for each mine and mining method assumed and are presented in each mine section of the AIF.

- The AgEq grade formula used was:

- A two-step constraining approach has been implemented to estimate Mineral Reserves for each mining method in use: A General Cut-Off Grade (“GC”) was used to delimit new mining areas that will require development of access, infrastructure and all sustaining costs. A second Incremental Cut-Off Grade (“IC”) was considered to include adjacent mineralized material which recoverable value pays for all associated costs, including but not limited to the variable cost of mining and processing, indirect costs, treatment, administration costs and plant sustaining costs but excludes the access development assumed to be covered by the block above the GC grade.

- The cut-off grades, metallurgical recoveries, payable terms and modifying factors used to convert Mineral Reserves from Mineral Resources are different for all mines and are presented in each mine section in the AIF.

- Modifying factors for conversion of resources to reserves include consideration for planned dilution which is based on spatial and geotechnical aspects of the designed stopes and economic zones, additional dilution consideration due to unplanned events, materials handling and other operating aspects, and mining recovery factors. Mineable shapes were used as geometric constraints.

- Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces. Metal prices and costs are expressed in USD.

- Numbers have been rounded as required by reporting guidelines. Totals may not sum due to rounding.

- The technical reports from which the above-mentioned information is derived are cited under the heading "Technical Reports for Material Properties" in the AIF.

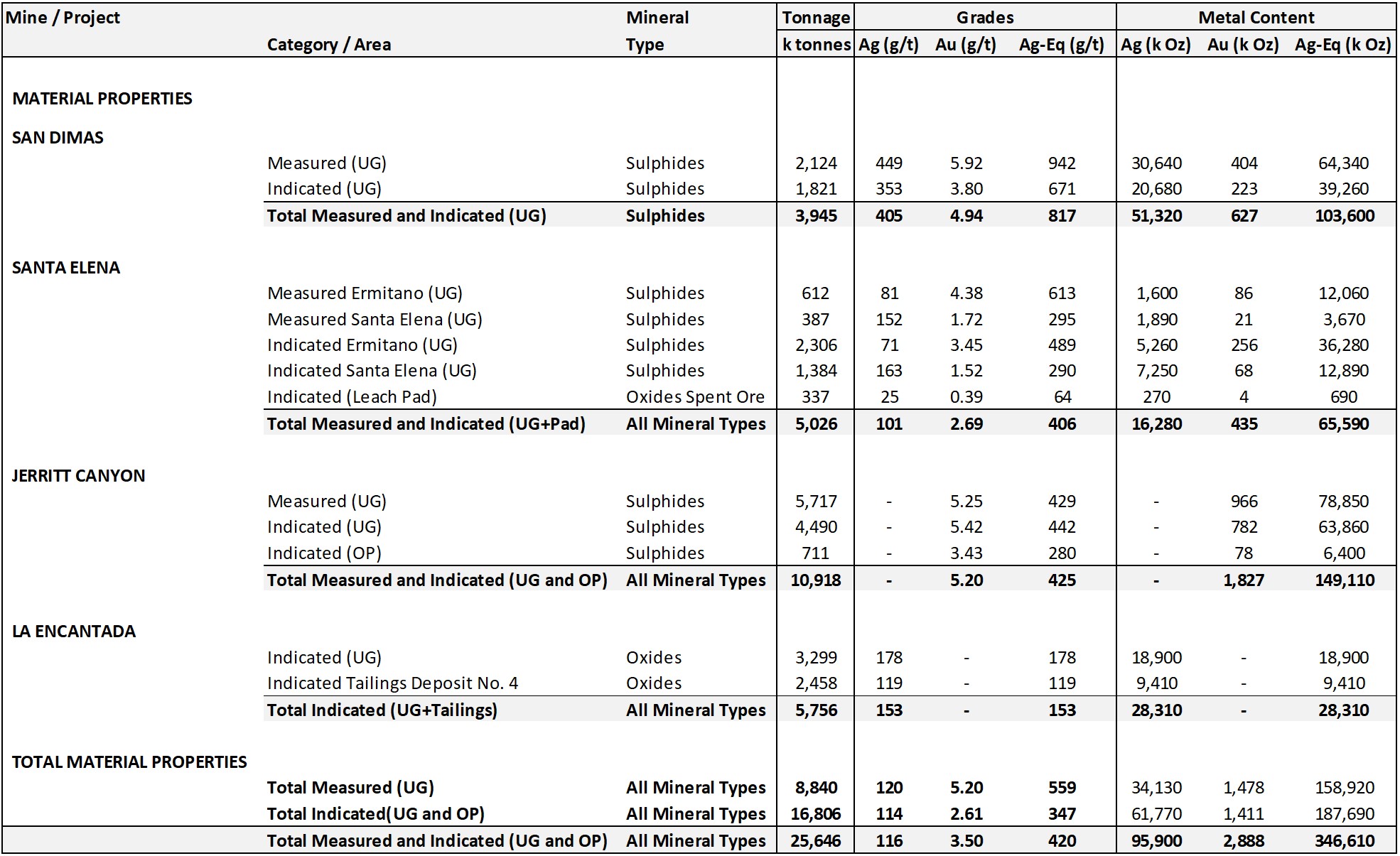

Measured and Indicated Mineral Resource Estimates for the Material Properties, with Effective Date of December 31, 2023 for San Dimas, Santa Elena, La Encantada, and Jerritt Canyon Mines.

- Mineral Resource estimates have been classified in accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101.

- The Mineral Resource estimates provided above have an effective date of December 31, 2023, except for the Santa Elena Leach Pad estimate, which has an effective date of March 11, 2024.

- The Mineral Resource estimates were prepared by the Company’s Internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. The Mineral Resource estimates were prepared under the supervision of, or were reviewed by, David Rowe, CPG, Internal QP for First Majestic, who is a Qualified Person under NI 43-101.

- Sample data was collected through a cut-off date of December 31, 2023 for the material properties except for the Santa Elena Leach Pad estimate, which has an effective date of March 11, 2024. All properties account for relevant technical information and mining depletion through December 31, 2023.

- Metal prices considered for Mineral Resource estimates were $24.5/oz Ag and $2,000/oz Au.

- Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the AIF.

- The cut-off grades and cut-off values used to report Mineral Resources are different for all mines. The cut-off grades, values and economic parameters are listed in the applicable section describing each mine section in the AIF.

- M&I Mineral Resource estimates are inclusive of the Mineral Reserve estimates.

- Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces. Totals may not add up due to rounding.

- The technical reports from which the above-mentioned information for the material properties is derived are cited under the heading "Technical Reports for Material Properties" in the AIF.

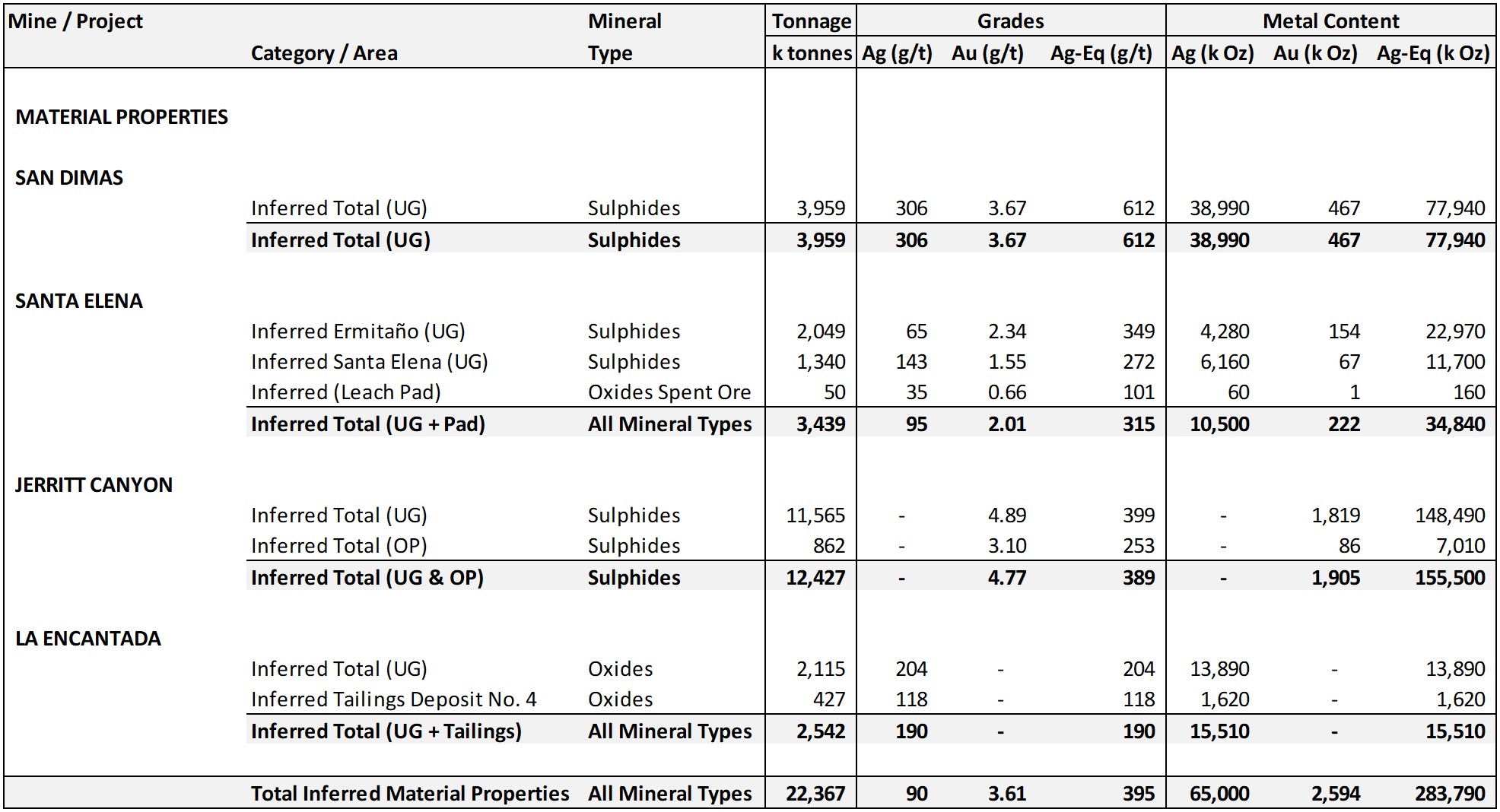

Inferred Mineral Resource Estimates for the Material Properties, with Effective Date of December 31, 2023 for San Dimas, Santa Elena, La Encantada, and Jerritt Canyon Mines.

- Mineral Resource estimates have been classified in accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101.

- The Mineral Resource estimates provided above have an effective date of December 31, 2023, except for the Santa Elena Leach pad estimate, which has an effective date of March 11, 2024. The Mineral Resource estimates were prepared by the Company’s Internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation.

- The Mineral Resource estimates were prepared under the supervision of, or were reviewed by, David Rowe, CPG, Internal QP for First Majestic, who is a Qualified Person under NI 43-101.

- Sample data was collected through a cut-off date of December 31, 2023 for the material properties, except for the Santa Elena Leach pad estimate, which has an effective date of March 11, 2024. All properties account for relevant technical information and mining depletion through December 31, 2023.

- Metal prices considered for Mineral Resource estimates were $24.5/oz Ag and $2,000/oz Au.

- Silver-equivalent grade is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the AIF.

- The cut-off grades and cut-off values used to report Mineral Resource estimates are different for all mines. The cut-off grades, values and economic parameters are listed in the applicable section describing each mine section in the AIF.

- Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces. Totals may not add up due to rounding.

- The technical reports from which the above-mentioned information for the material properties is derived are cited under the heading "Technical Reports for Material Properties" in the AIF.

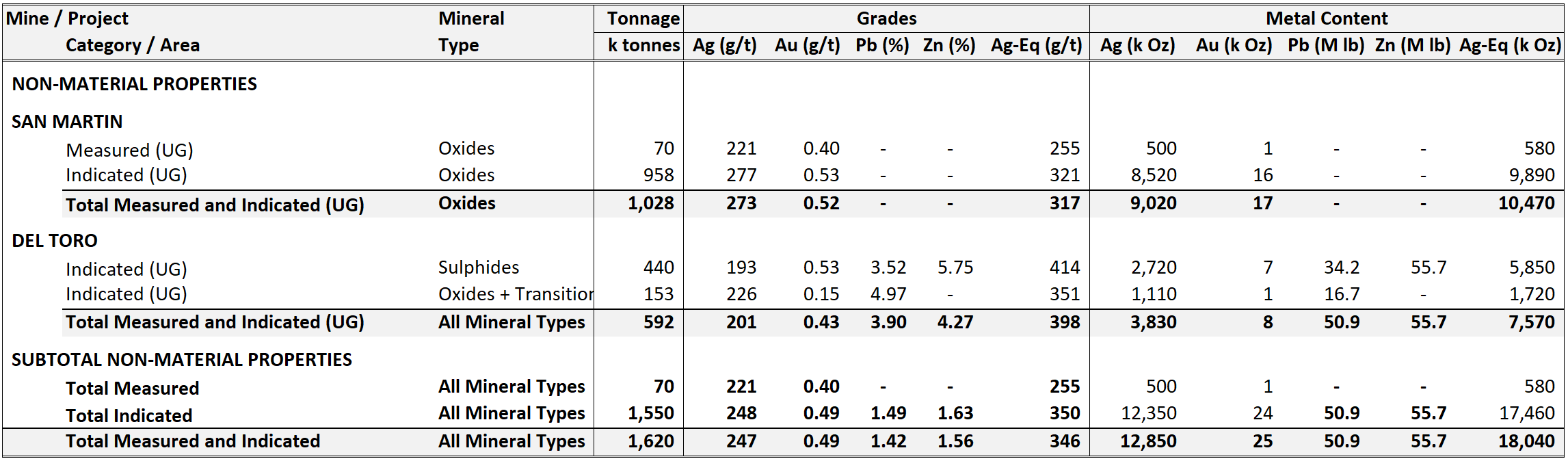

Measured and Indicated Mineral Resource Estimates for the Non-Material Properties, with Effective dates of December 31, 2020.

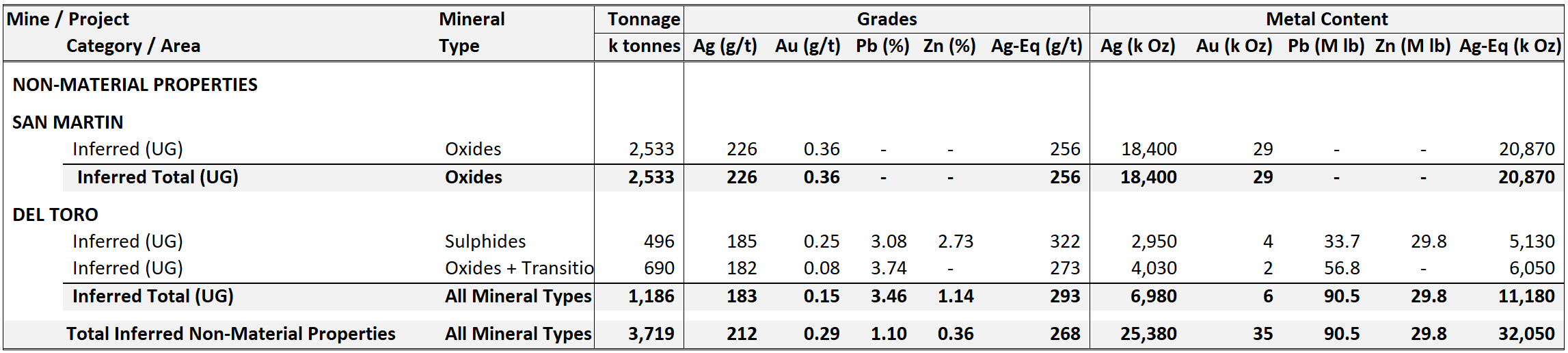

Inferred Mineral Resource Estimates for the Non-Material Properties, with Effective dates of December 31, 2020.

- Mineral Resource estimates have been classified in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument NI 43-101.

- The Mineral Resource estimates for the non-material properties were updated December 31, 2020. The estimates were prepared by FMS Internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. The information provided was compiled by David Rowe, CPG, Internal QP for First Majestic, and reviewed by Gonzalo Mercado, P.Geo. Internal QP for First Majestic.

- Sample data was collected through a cut-off date of December 31, 2020, for the three non-material properties.

- Metal prices considered for Mineral Resources estimates of the other three non-material properties on December 31, 2020, were $22.50/oz Ag, $1,850/oz Au, $0.90/lb Pb and $1.05/lb Zn.

- Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine.

- The cut-off grades and cut-off values used to report Mineral Resources are different for all mines. The cut-off grades, values and economic parameters are listed in the applicable section describing each mine section of the AIF.

- Tonnage is expressed in thousands of tonnes, metal content is expressed in thousands of ounces. Totals may not add up due to rounding.

NI 43-101 Technical Reports

Material Assets

Non-Material Assets

Cautionary Notes to U.S. Investors Concerning Reserve and Resource Estimates

The definitions of Proven and Probable Reserves used in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") differ from the definitions in the United States Securities and Exchange Commission ("SEC") Industry Guide 7. Under SEC Guide 7 standards, a "Final" or "Bankable" feasibility study is required to report reserves, the three year history average price and CIBC three year metal price projection are used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into Reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this website containing descriptions of First Majestic's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations there under.