First Majestic Updates Mineral Reserve and Resource Estimates for Year End 2015 and Files Form 40-F Annual Report

March 31, 2016

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 31, 2016) - FIRST MAJESTIC SILVER CORP. (the "Company" or "First Majestic") (FRANKFURT:FMV)(TSX:FR)(NYSE:AG)(BVM:AG) is pleased to announce its 2015 Mineral Reserve and Resource estimates for its existing mineral property assets in Mexico as of December 31, 2015. Metal prices used to estimate the 2015 reserve estimates were reduced compared to previous estimates to: $17.50/oz for silver, $1,200/oz for gold, $0.85/lb for lead and $0.85/lb for zinc.

The following table shows the total tonnage mined from each of the Company's six producing properties during 2015, including total ounces of silver and silver equivalent ounces produced from each property and the tonnage mined from delineated reserves and resources at each property.

2015 Production Table

| LA ENCANTADA | LA PARRILLA | DEL TORO | SAN MARTIN | LA GUITARRA | SANTA ELENA (2) |

TOTAL | |

| TONNES OF ORE PROCESSED | 851,567 | 667,702 | 555,564 | 349,193 | 174,003 | 254,625 | 2,852,654 |

| OZ OF SILVER PRODUCED | 2,529,785 | 2,434,095 | 2,261,633 | 2,296,965 | 945,662 | 673,969 | 11,142,109 |

| OZ OF SILVER EQ. PRODUCED FROM OTHER METALS (1) | 9,655 | 1,602,303 | 1,562,608 | 425,094 | 512,066 | 832,436 | 4,944,162 |

| TOTAL OZ OF SILVER EQ. PRODUCED | 2,539,440 | 4,036,398 | 3,824,241 | 2,722,059 | 1,457,728 | 1,506,405 | 16,086,271 |

| TONNES MINED FROM MATERIAL IN RESERVES | 244,186 | 589,479 | 526,534 | 303,777 | 120,182 | 254,625 | 2,038,783 |

| TONNES MINED FROM MATERIAL NOT IN RESERVES | 607,381 | 78,223 | 29,030 | 45,416 | 53,821 | - | 813,871 |

| (1) | Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. |

| (2) | Santa Elena production corresponds to the period October 1, 2015 to December 31, 2015. |

| (3) | Totals may not add up due to rounding. |

The Company completed 36,098 metres of diamond drilling at its six operating mines in 2015, representing an 18% reduction in metres drilled compared to the prior year. For 2016, First Majestic is planning to drill approximately 65,000 metres to further define known mineralized ore bodies at its operating mines. A combination of surface and underground drill rigs will focus on assisting mining activities, definition drilling and to support future updates to the Company's NI 43-101 Technical Reports.

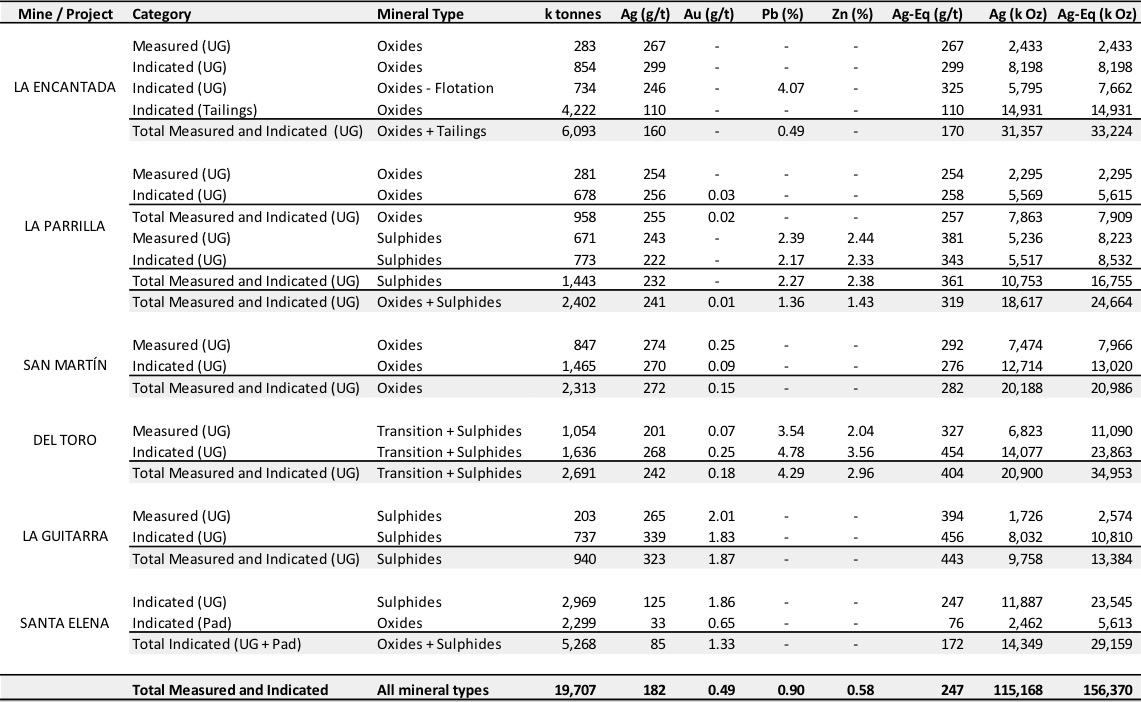

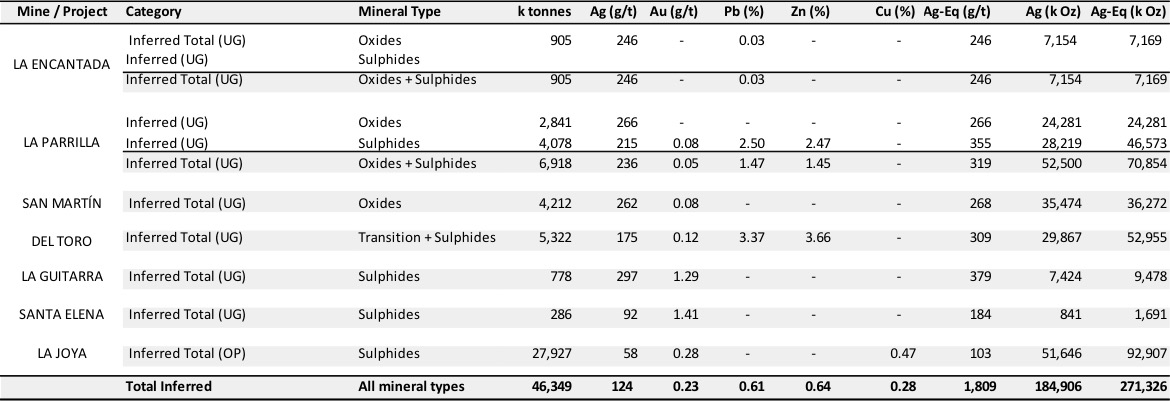

Metal content in the Proven and Probable Reserve category totaled 100.6 million ounces of silver, relatively unchanged from the Company's previous estimate of 101.1 million ounces of silver. The most significant change to Mineral Reserves, apart from the addition of the Santa Elena mine, occurred at La Encantada where the old tailings were upgraded from Inferred Resources to Probable Reserves following the significant improvement in silver recoveries from 15% to 70% due to the roasting of tailings. This upgrade resulted in a 48% decrease in the silver reserve grade to 143 g/t due to a 109% increase in tonnes, mostly consisting of low grade tailings. Silver metal content in the Measured and Indicated Resource category totaled 115.2 million ounces, representing a 24% decrease from 2014 estimates primarily due to the reclassification of the La Luz project as a historical resource, offset by the addition of the Santa Elena mine. In addition, the silver metal content in the Inferred Resource totaled 184.9 million ounces, representing an increase of 9% compared to previous estimates primarily due to the addition of the La Joya property which was acquired as a result of the acquisition of SilverCrest Mines Ltd.

The complete 2015 Mineral Reserve and Resource estimates for all metals, tonnage and grades are shown below in the following tables:

PROVEN AND PROBABLE MINERAL RESERVES WITH AN EFFECTIVE DATE OF DECEMBER 31, 2015

| Mine | Category | Mineral Type | k tonnes |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

|

| LA ENCANTADA | Proven (UG) | Oxides | 251 | 247 | - | - | - | 247 | 1,991 | 1,991 | |

| Probable (UG) | Oxides | 1,473 | 214 | - | - | - | 214 | 10,120 | 10,120 | ||

| Probable (UG) | Oxides - Flotation | 809 | 147 | - | 2.35 | - | 196 | 3,817 | 5,093 | ||

| Probable (Tailings) | Oxides | 4,138 | 110 | - | - | - | 110 | 14,633 | 14,633 | ||

| Total Proven and Probable (UG) | Oxides + Tailings | 6,670 | 143 | - | 0.29 | - | 148 | 30,561 | 31,837 | ||

| LA PARRILLA | Proven (UG) | Oxides | 239 | 230 | - | - | - | 230 | 1,769 | 1,769 | |

| Probable (UG) | Oxides | 576 | 242 | - | - | - | 242 | 4,481 | 4,481 | ||

| Total Proven and Probable (UG) | Oxides | 815 | 238 | - | - | - | 238 | 6,251 | 6,251 | ||

| Proven (UG) | Sulphides | 676 | 212 | - | 2.15 | 2.27 | 331 | 4,610 | 7,210 | ||

| Probable (UG) | Sulphides | 870 | 191 | - | 1.86 | 2.00 | 296 | 5,346 | 8,266 | ||

| Total Proven and Probable (UG) | Sulphides | 1,546 | 200 | - | 1.99 | 2.12 | 311 | 9,956 | 15,475 | ||

| Total Proven and Probable (UG) | Oxides + Sulphides | 2,362 | 213 | - | 1.30 | 1.39 | 286 | 16,207 | 21,726 | ||

| SAN MARTÍN | Proven (UG) | Oxides | 685 | 251 | 0.25 | - | - | 269 | 5,523 | 5,915 | |

| Probable (UG) | Oxides | 1,074 | 269 | 0.10 | - | - | 276 | 9,281 | 9,526 | ||

| Total Proven and Probable (UG) | Oxides | 1,759 | 262 | 0.16 | - | - | 273 | 14,804 | 15,440 | ||

| DEL TORO | Proven (UG) | Transition + Sulphides | 870 | 199 | 0.07 | 3.58 | 1.94 | 319 | 5,555 | 8,911 | |

| Probable (UG) | Transition + Sulphides | 1,244 | 297 | 0.22 | 5.29 | 3.08 | 483 | 11,875 | 19,326 | ||

| Total Proven and Probable (UG) | Transition + Sulphides | 2,114 | 256 | 0.16 | 4.59 | 2.61 | 415 | 17,430 | 28,238 | ||

| LA GUITARRA | Proven (UG) | Sulphides | 169 | 223 | 1.75 | - | - | 333 | 1,210 | 1,808 | |

| Probable (UG) | Sulphides | 817 | 260 | 1.41 | - | - | 349 | 6,820 | 9,157 | ||

| Total Proven and Probable (UG) | Sulphides | 986 | 253 | 1.47 | - | - | 346 | 8,030 | 10,965 | ||

| SANTA ELENA | Probable (UG) | Sulphides | 3,210 | 107 | 1.57 | - | - | 208 | 11,059 | 21,499 | |

| Probable (PAD) | Oxides Spent Ore | 2,299 | 33 | 0.65 | - | - | 75 | 2,462 | 5,556 | ||

| Total Probable | Oxides + Sulphides | 5,509 | 76 | 1.19 | - | - | 153 | 13,521 | 27,054 | ||

| Total Proven and Probable | All mineral types | 19,399 | 161 | 0.44 | 0.76 | 0.45 | 217 | 100,554 | 135,260 |

| (1) | Mineral Reserves have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") |

| (2) | Metal prices considered for Mineral Reserves estimates were $17.50 USD/oz Ag, $1,200 USD/oz Au, $0.85 USD/lb Pb, and $0.85 USD/lb Zn. |

| (3) | The Mineral Reserves information provided above for La Encantada, La Parrilla, Del Toro, San Martín, La Guitarra and Santa Elena is based on internal estimates prepared as of December 31, 2015. The information provided was reviewed and validated by the Company's internal Qualified Person, Mr. Ramon Mendoza Reyes, P.Eng., who has the appropriate relevant qualifications, and experience in mining and reserves estimation practices |

| (4) | Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the 2015 Annual Information Form. |

| (5) | The cut-off grades and modifying factors used to convert Mineral Reserves from Mineral Resources are different for all mines. The cut-off grades and factors are listed in each mine section of the 2015 Annual Information Form. |

MEASURED AND INDICATED MINERAL RESOURCES WITH AN EFFECTIVE DATE OF DECEMBER 31, 2015

INFERRED MINERAL RESOURCES WITH AN EFFECTIVE DATE OF DECEMBER 31, 2015

(1) Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

(2) In all cases, metal prices considered for Mineral Resource estimates were $18.50 USD/oz Ag, $1,300 USD/oz Au, $0.95 USD/lb Pb, and $0.95 USD/lb Zn.

(3) The Mineral Resources information provided above for La Parrilla, Del Toro and San Martín is based on internal estimates prepared as of December 31, 2015. The information provided was reviewed and validated by the Company’s internal Qualified Person, Mr. Jesus M. Velador Beltran, MMSA QP Geology, who has the appropriate relevant qualifications, and experience in geology and resource estimation.

(4) Mineral Resource estimates for La Guitarra Silver Mine are based on information contained in the 2015 Technical Report compiled by First Majestic, which were updated by First Majestic with information to December 31, 2015.

(5) Mineral Resource estimates for La Encantada Silver Mine are based on the 2016 Technical Report compiled by First Majestic.

(6) Inferred Mineral Resource estimates for La Joya Project are based on the 2013 Technical Report prepared for Silvercrest.

(7) Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the 2015 Annual Information Form.

(8) The cut-off grades for Mineral Resources are different for all mines. The cut-off grades are listed in each mine section of the 2015 Annual Information Form.

(9) Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves.

The Company also announces that its 2015 Annual Information Form has been filed on SEDAR. In addition, a Form 40-F report has been filed with the United States Securities and Exchange Commission and is available on EDGAR. Both documents are also available on the Company’s website at www.firstmajestic.com.

Shareholders may also receive a copy of First Majestic’s Annual Report which includes the audited financial statements, without charge, upon request to First Majestic, Suite 1805 – 925 West Georgia Street Vancouver, B.C., Canada, V6C 3L2 or to info@firstmajestic.com.

Mr. Ramon Mendoza Reyes, Vice President Technical Services for First Majestic, is a "qualified person" as such term is defined under National Instrument 43-101, and has reviewed and approved the technical information disclosed in this news release.

First Majestic is a mining company focused on silver production in México and is aggressively pursuing the development of its existing mineral property assets and the pursuit through acquisition of additional mineral assets which contribute to the Company achieving its corporate growth objectives.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer, President & CEO

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “schedule” and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things: the price of silver and other metals; the accuracy of mineral reserve and resource estimates and estimates of future production and costs of production at our properties; estimated production rates for silver and other payable metals produced by us, the estimated cost of development of our development projects; the effects of laws, regulations and government policies on our operations, including, without limitation, the laws in Mexico which currently have significant restrictions related to mining; obtaining or maintaining necessary permits, licences and approvals from government authorities; and continued access to necessary infrastructure, including, without limitation, access to power, land, water and roads to carry on activities as planned.

These statements reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in the spot and forward price of silver, gold, base metals or certain other commodities (such as natural gas, fuel oil and electricity); fluctuations in the currency markets (such as the Canadian dollar and Mexican peso versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments in Canada, Mexico; operating or technical difficulties in connection with mining or development activities; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom the Company does business; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on mining, including those currently enacted in Mexico; employee relations; relationships with and claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses, permits and approvals from government authorities; diminishing quantities or grades of mineral reserves as properties are mined; the Company’s title to properties; and the factors identified under the caption “Risk Factors” in the Company’s Annual Information Form, under the caption “Risks Relating to First Majestic's Business”.

Investors are cautioned against attributing undue certainty to forward-looking statements or information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.