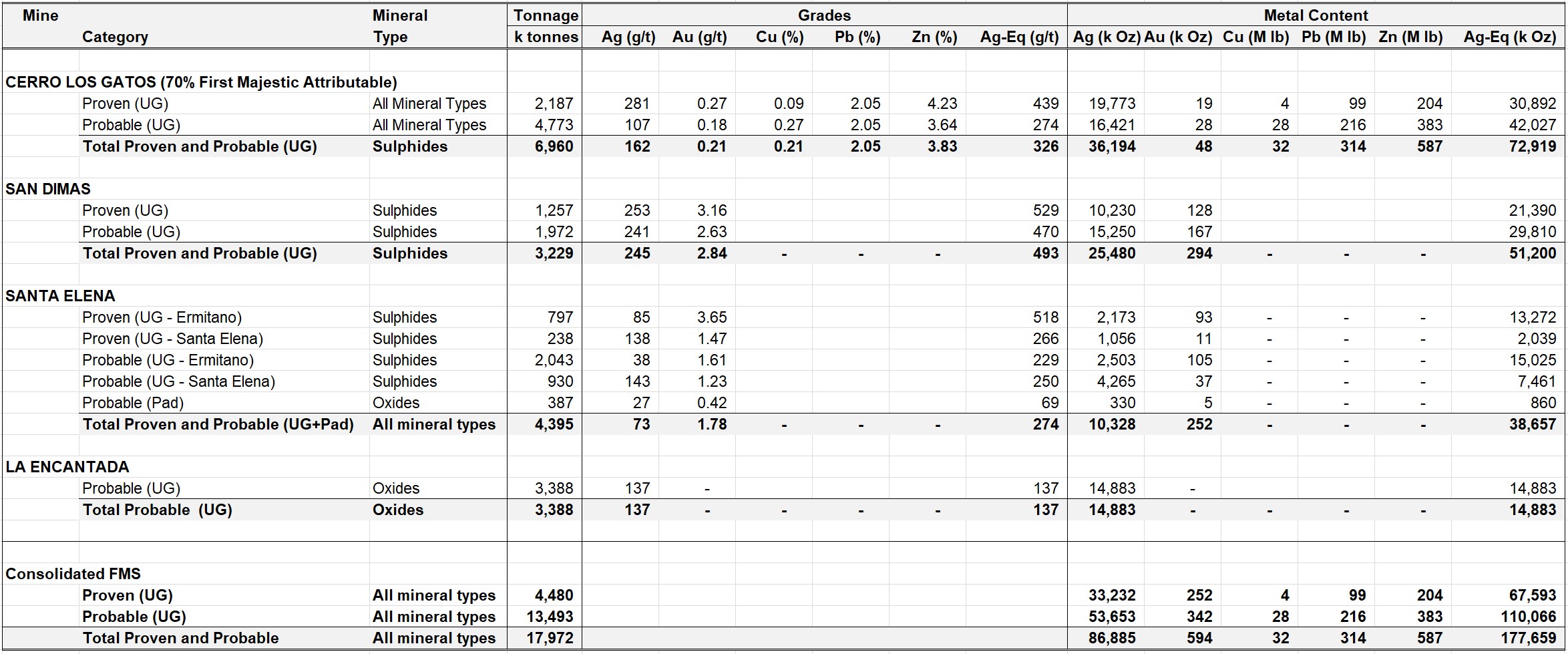

Proven and Probable Mineral Reserve Estimates with an Effective Date of December 31, 2024.

- Mineral Reserves are classified per CIM Definition Standards and NI 43-101, derived from Measured & Indicated Resources, and are reported with a reference point of mined ore delivered to the plant.

- For San Dimas, Santa Elena and La Encantada: Mineral Reserves are effective December 31, 2024, and account for depletion to that date.

- For Los Gatos: Mineral Reserves are effective July 1, 2024, account for depletion to December 31, 2024, and are reported on a 70% attributable basis to the Company.

- Reserve estimates were supervised or reviewed by Andrew Pocock, P.Eng., Internal Qualified Person for First Majestic per NI 43-101.

- Silver equivalent grade is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the selling contract. The AgEq grade formulas vary and are presented in each mine section of the AIF.

- Metal prices for Mineral Reserves estimates for the Santa Elena, San Dimas and La Encantada properties were $26/oz Ag and $2,200 oz Au; and metal prices for the Los Gatos property were $23/oz Ag, $1,850/oz Au, $0.95/lb Pb, $1.25/lb Zn and $4.0/lb Cu.

- Modifying factors for conversion of resources to reserves include but are not limited to consideration for mining methods, mining recovery, dilution, sterilization, depletion, cutoff grades, geotechnical conditions, metallurgical factors, infrastructure, operability, safety, environmental, regulatory, social and legal factors. These factors were applied to produce mineable stope shapes. These parameters are different for each mine and mining method assumed and are presented in each mine section of the AIF.

- The cutoff grades, metallurgical recoveries, payable terms and modifying factors used to convert Mineral Reserves from Mineral Resources are different for all mines and are presented in each mine section in the 2024 AIF.

- Modifying factors for conversion of resources to reserves include consideration for planned dilution which is based on spatial and geotechnical aspects of the designed stopes and economic zones, additional dilution consideration due to unplanned events, materials handling and other operating aspects, and mining recovery factors. Mineable shapes were used as geometric constraints.

- Tonnage in thousands of tonnes, metal content in thousands of ounces, prices/costs in USD. Numbers are rounded, and as a result, may not sum due to rounding.

- The technical reports from which the above-mentioned information is derived are cited under the heading "Technical Reports for Material Properties" in the 2024 AIF.

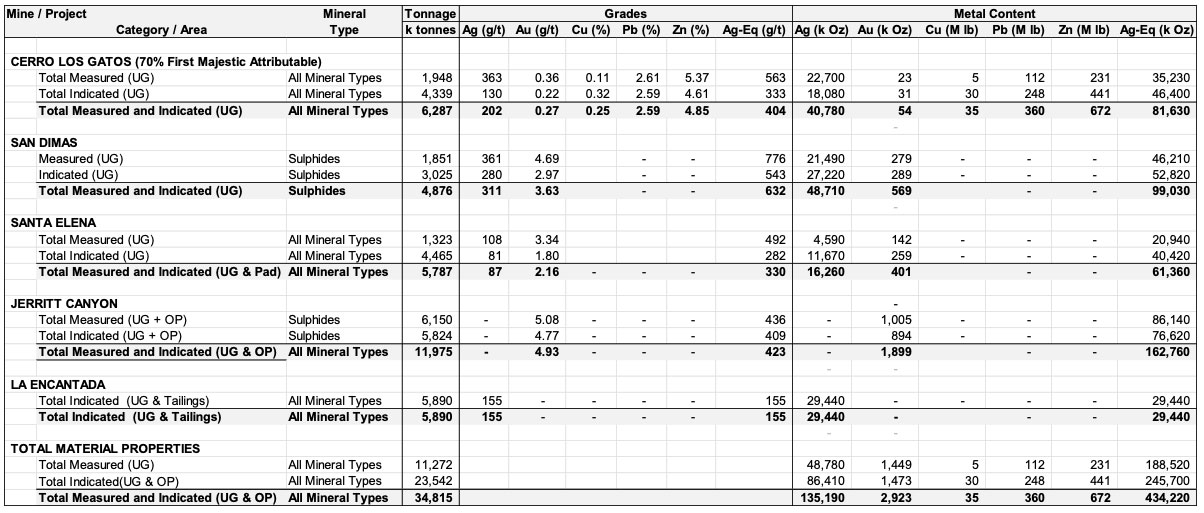

Measured and Indicated Mineral Resource Estimates with an Effective Date of December 31, 2024, for Los Gatos (70%), Santa Elena, San Dimas, La Encantada, and Jerritt Canyon Mines.

- Mineral Resource estimates are classified per CIM Definition Standards and NI 43-101.

- The Mineral Resource estimates have an effective date of December 31, 2024. Sample data was collected through a cutoff date of December 31, 2024, for the Material Properties except for the Los Gatos estimate, which was March 31, 2024. All properties account for relevant technical information and mining depletion through December 31, 2024.

- The Los Gatos Mineral Resources are reported on a 70% FM attributable basis.

- Mineral Resource estimates were supervised or reviewed by David Rowe, CPG, Internal Qualified Person for First Majestic, per NI 43-101.

- Silver equivalent grade is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the AIF.

- Metal prices considered for all Mineral Resources estimates for the Santa Elena, San Dimas, Jerritt Canyon and La Encantada properties were $28/oz Ag and $2,400 oz Au. Metal prices considered for the Los Gatos Silver Mine were $23/oz Ag, $1,850/oz Au, $0.95/lb Pb, $1.25/lb Zn and $4.0/lb Cu.

- The cutoff grades and cutoff values used to report Mineral Resources are different for all mines. The cutoff grades, values and economic parameters are listed in the applicable section describing each mine section of the 2024 AIF.

- Mineral Resources are reported within mineable stope shapes or open pit shapes the cutoff values calculated using the stated metal prices and metal recoveries in the mine section of the AIF. The cutoff values include mill recoveries and payable metal factors appropriate to the existing processing circuit.

- No dilution was applied to the Mineral Resource which are reported on an in-situ basis.

- Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces and millions of pounds. Totals may not add up due to rounding.

- Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The technical reports from which the above-mentioned information for the material properties is derived are cited under the heading "Technical Reports for Material Properties " of the 2024 AIF.

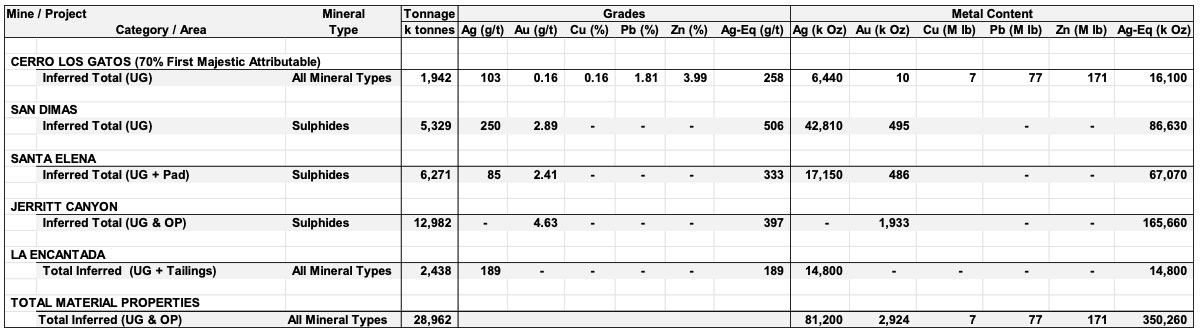

Inferred Mineral Resource Estimates with an Effective Date of December 31, 2024, for Los Gatos (70%), Santa Elena, San Dimas, La Encantada, and Jerritt Canyon Mines.

- Mineral Resource estimates are classified per CIM Definition Standards and NI 43-101.

- The Mineral Resource estimates have an effective date of December 31, 2024. Sample data was collected through a cutoff date of December 31, 2024, for the Material Properties except for the Los Gatos estimate, which was March 31, 2024. All properties account for relevant technical information and mining depletion through December 31, 2024.

- The Los Gatos Mineral Resources are reported on a 70% FM attributable basis.

- Mineral Resource estimates were supervised or reviewed by David Rowe, CPG, Internal Qualified Person for First Majestic, per NI 43-101.

- Silver equivalent grade is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the AIF.

- Metal prices considered for all Mineral Resources estimates for the Santa Elena, San Dimas, Jerritt Canyon and La Encantada properties were $28/oz Ag and $2,400 oz Au. Metal prices considered for the Los Gatos Silver Mine were $23/oz Ag, $1,850/oz Au, $0.95/lb Pb, $1.25/lb Zn and $4.0/lb Cu.

- The cutoff grades and cutoff values used to report Mineral Resources are different for all mines. The cutoff grades, values and economic parameters are listed in the applicable section describing each mine section of the 2024 AIF.

- Mineral Resources are reported within mineable stope shapes or open pit shapes the cutoff values calculated using the stated metal prices and metal recoveries in the mine section of the AIF. The cutoff values include mill recoveries and payable metal factors appropriate to the existing processing circuit.

- No dilution was applied to the Mineral Resource which are reported on an in-situ basis.

- Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces and millions of pounds. Totals may not add up due to rounding.

- Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The technical reports from which the above-mentioned information for the material properties is derived are cited under the heading "Technical Reports for Material Properties " of the 2024 AIF.

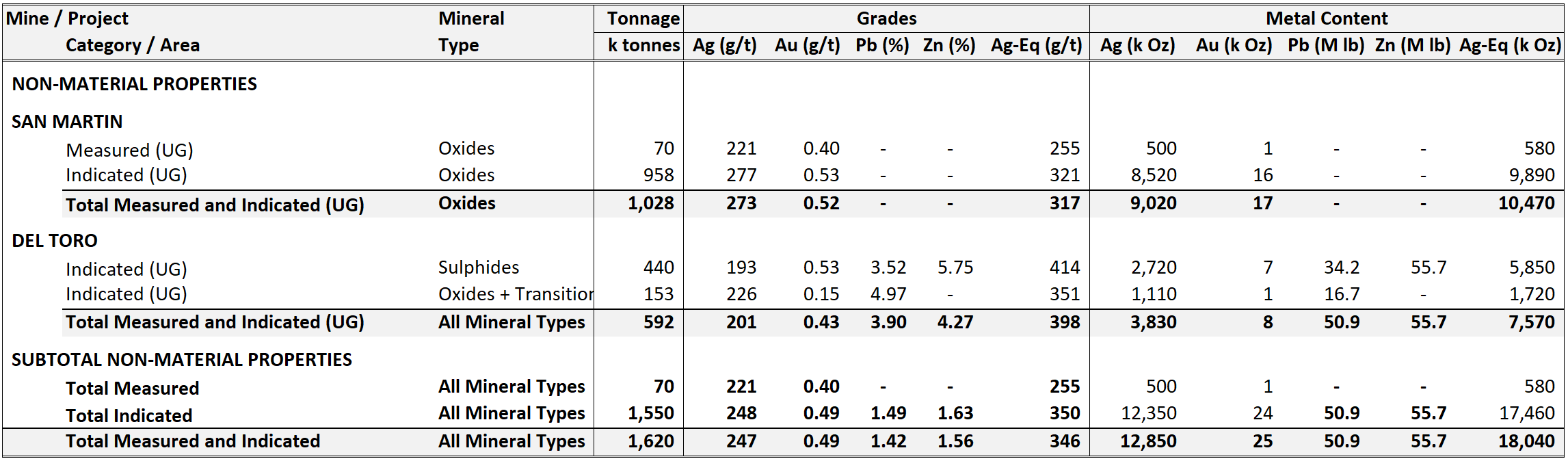

Measured and Indicated Mineral Resource Estimates for the Non-Material Properties, with Effective dates of December 31, 2020.

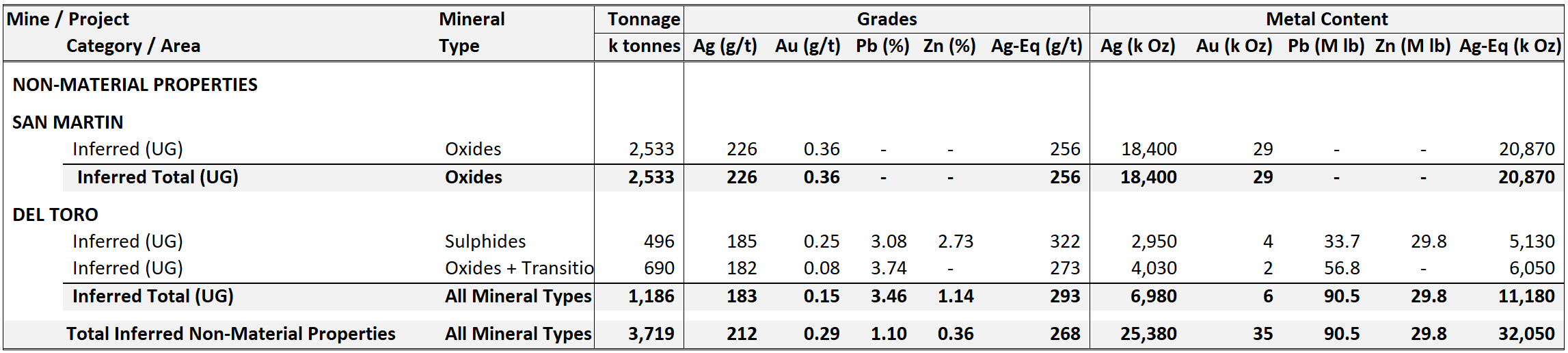

Inferred Mineral Resource Estimates for the Non-Material Properties, with Effective dates of December 31, 2020.

- Mineral Resource estimates have been classified in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument NI 43-101.

- The Mineral Resource estimates for the non-material properties were updated December 31, 2020. The estimates were prepared by FMS Internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. The information provided was compiled by David Rowe, CPG, Internal QP for First Majestic, and reviewed by Gonzalo Mercado, P.Geo. Internal QP for First Majestic.

- Sample data was collected through a cut-off date of December 31, 2020, for the three non-material properties.

- Metal prices considered for Mineral Resources estimates of the other three non-material properties on December 31, 2020, were $22.50/oz Ag, $1,850/oz Au, $0.90/lb Pb and $1.05/lb Zn.

- Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine.

- The cut-off grades and cut-off values used to report Mineral Resources are different for all mines. The cut-off grades, values and economic parameters are listed in the applicable section describing each mine section of the AIF.

- Tonnage is expressed in thousands of tonnes, metal content is expressed in thousands of ounces. Totals may not add up due to rounding.

NI 43-101 Technical Reports

Material Assets

Non-Material Assets

Cautionary Notes to U.S. Investors Concerning Reserve and Resource Estimates

The definitions of Proven and Probable Reserves used in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") differ from the definitions in the United States Securities and Exchange Commission ("SEC") Industry Guide 7. Under SEC Guide 7 standards, a "Final" or "Bankable" feasibility study is required to report reserves, the three year history average price and CIBC three year metal price projection are used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into Reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this website containing descriptions of First Majestic's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations there under.